Types of Financial Market | Financial Market Definition

Financial Markets and Institutions: An Introduction

The Stock Market

A stock market is essentially a trading ground in which stocks are bought and sold. The market may be an actual physical location, as in the case of the New York Stock Exchange; or virtual, as with Nasdaq.

The term “stock” refers to a share of a company or a business. Stock holders – those who have ownership of stocks in a particular firm – are essentially part owners of that company.

The current state of the stock market is typically referred to as an index. This is determined by a number of indicators, such as the Nasdaq Composite or the Dow Jones Industrial Average. When determining the index, a certain amount of stocks is averaged in order to gauge the performance of a particular market.

The index is really more relevant to shareholders who have a large volume of stock. Shareholders that have stocks in only one or two firms don’t really get any definitive indicators on the current state of their stocks based on the index. Even so, the index does provide an indication of the general climate of trading among investors and traders.

The Bond Market

The bond market deals solely in bonds, which basically represents borrowed money. Bonds are usually obtained for the purpose of generating capital. Under the terms of the agreement, lenders are compensated via various types of interest payments.

Bonds differ significantly from equity markets, in which buyers have ownership of a portion of the company in perpetuity. In the case of a bond market, it is agreed that borrowers will pay back the money at a predetermined date.

Bond markets differ from other lending vehicles in other ways, as well. Borrowers will often borrow money from a single lending institution. With the bond market, on the other hand, the money is sourced from a group of investors. This not only ensures that the borrowers have access to more funds, but also spreads the credit risk between more lending firms or individuals.

The Commodity Market

Commodity markets deal primarily with the exchange of commodities. Again, it shares many similarities with equity markets, although in this case, a commodity is traded instead of shares.

Commodity markets are actually among the oldest and longest-running markets in the world. Derivatives (which are another type of financial market) can trace their roots to early commodity markets. As far back as the 17th century, rice futures were bought and sold in Japan.

Nowadays, there are numerous types of commodities traded in commodity markets. Most everything of value is traded in markets all over the world. Among these are:

- gold, silver, and platinum

- nickel, aluminum, and copper

- wheat, cotton, corn, and oils

- coffee, cocoa, and sugar

- livestock or livestock products

- oil, gasoline, and natural gas

Commodity markets can be one of two types: Over the Counter (OTC) or exchange-based. There are also spot and derivatives segments that fall within the commodity markets.

The two segments – spot markets and derivatives – are themselves quite distinct from each other. Spot markets are considered over-the-counter markets in which the trades involve those that have a direct involvement in that particular commodity. In the derivatives market, on the other hand, much of the activity takes place via exchange-based markets. These trades tend to be more formal, with standard contracts, settlements, and the like.

The Derivatives Market

The derivatives market deals primarily in the exchange of derivatives. These are financial instruments whose performance is determined by the performance of underlying assets. Known as “underlying”, these are bought and sold with cash or spot markets. When discussing the value of a particular underlying, traders typically make reference to the cash or spot price.

Derivatives themselves may be grouped into two categories: forward commitments and contingent claims.

In forward commitments, both parties agree to a predetermined price in the future, which is referred to as the forward price. As part of the agreement, the underlying type and quantity is specified beforehand. Both parties also agree to a date when the transaction will take place and how the settlement will be handled.

In contingent claims, the payoff is subject to the outcome of the underlying, just as it is with forward commitments. The key difference is that the parties in a contingent claim may opt not to pursue the transaction. With forward commitments on the other hand, both parties have a legal obligation to carry out the transaction.

Because claim holders have the option to cancel or push through with the transaction, contingent claim are often referred to as “options”.

In the derivatives market, trades tend to be standardized and transparent. They are also subject to strict regulations. Transactions carried out in this market are guaranteed against default via the exchange’s clearinghouse.

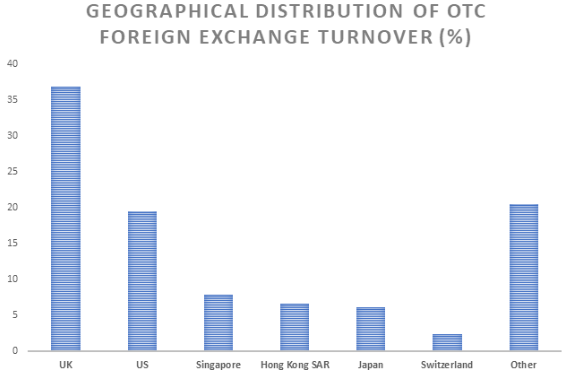

The Forex Market

Forex or foreign exchange (add link to what is forex trading article) is a global trading market where currencies are bought and sold. Also referred to as currency trading or simply FX, it is the world’s largest trading market, as well as the most liquid. Every day, the trading volume on the forex market averages more than $5 trillion. This alone makes it far exceed the global stock market in terms of scope and volume. Often, traders will use a variety of forex news sites to help them stay up to date on the latest trading news, which assists them in making sound trading decisions.

Trades on the forex market are carried out on forex trading platforms, with traders constantly monitoring the state of the market. Trades always involve a pair of currencies, with the value of each measured against each other. In any given pair, the first currency represents the base, with the second being the counter. In the currency pair EUR/USD for example, the Euro is the base, while the US dollar is the counter. In that particular pair, the value of one Euro is represented by a certain amount of dollars.

Having a thorough understanding of the different financial markets is key to building a strong trading strategy. As you learn about the various characterizations of the different markets, you may discover you enjoy trading within certain markets versus the other ones. To learn more about the different financial markets, including regulations, trading strategies, and more, contact Forest FX Park today.