ThinkMarkets Review

ThinkMarkets Review

*Updated on 11/15/2021

ThinkMarkets, formerly known as ThinkForex, is a forex and CFD broker that was established in 2010. ThinkMarkets offers both retail and institutional clients the ability to trade in a variety of financial instruments, including currency pairs, precious metals, *cryptocurrencies, commodities, Indices, Shares, ETFs and Futures.

*Crypto CFDs are not offered to retail traders in the UK.

ThinkMarkets offers clients the option to choose between several types of accounts as well as trading platforms. Moreover, customers who choose ThinkMarkets will have access to a vast library of educational resources and fantastic trading tools, like Trading Central and VPS Hosting. These features, combined with tight spreads and low commission rates make ThinkMarkets a great option for both inexperienced and advanced traders.

Regulation

ThinkMarkets is regulated in several jurisdictions as:

- TF Global Markets (UK) Limited is authorized and regulated by the Financial Conduct Authority (FCA).

- TF Global Markets (Aust) Limited is authorized and regulated by the Australian Securities and Investments Commissions (ASIC).

- TF Global Markets (South Africa) (Pty) Ltd is authorized and regulated by the South Africa Financial Sector Conduct Authority (FSCA).

- TF Global Markets Int Limited is authorized and regulated by the Financial Services Authority, Seychelles (FSA).

- TF Global Markets (Europe) Ltd is authorized and regulated by the Cyprus Securities & Exchange Commission (CySEC).

- TF Global Markets (Japan) Limited is authorized and regulated by the Japanese Financial Services Agency (JFSA).

REGIONS AVAILABLE

ThinkMarkets is an available broker in the Forest Park FX cash back rebate program to traders in Latin America, Europe, Middle East, and APAC regions, subject to certain country-specific restrictions. Due to regulations it is not currently available to United States or Canadian residents.

*your capital is at risk. 71.18% of Retail CFD Accounts Lose Money.

Minimum Deposit

The minimum deposit requirement at ThinkMarkets is zero on the Standard account. The ThinkZero account has a minimum deposit requirement of 500 in any accepted unit of currency.

Types of Accounts

ThinkMarkets offers several different types of accounts to accommodate the varying needs of its customers.

Standard Account

You can open a Standard account without depositing any funds and this account is completely commission free. Standard Account holders are offered Forex spreads from as low as 0.4pips.

Additionally, ThinkMarkets offers all customers access to live support 24 hours a day, seven days per week as well as access to daily market insights.

ThinkZero Account

ThinkZero Accounts at ThinkMarkets require a minimum deposit of 500 and have a commission of $3.5 units per side (3 Euros / 2.5 GBP) — for all FX pairs and metals. According to ThinkMarkets, ThinkZero Account holders can expect Forex spreads from as low as 0 pips and CFD spreads from as low as 0.4 points.

ThinkZero Account holders have access to the same tools as Standard Account holders, which include:

- An Economic Calendar – Which is constantly updated

- Free VPS Service – Subject to qualifying requirements

- Trading Central – Free on MT4 and MT5 to all ThinkMarkets clients

- ThinkZero account holders have the additional benefit of an account manager

Like Standard Accounts, the maximum leverage* for ThinkZero Accounts is 500:1 depending on the ThinkMarkets entity. Additionally, ThinkZero and Standard Accounts share a minimum contract size of 0.01. Leverage ratio vary by country of residence / ThinkMarkets entity.

*Leverage ratio vary by country of residence / ThinkMarkets entity.

Joint Account

Lastly, ThinkMarkets offers joint accounts. These accounts, of course, are meant to be shared by two or more individuals.

ThinkMarkets provides Islamic clients with the option to open a swap-free account which complies with Sharia law.

If you are interested in setting up either a joint or Islamic account, you can do so through Forest Park FX.

Commissions & Fees

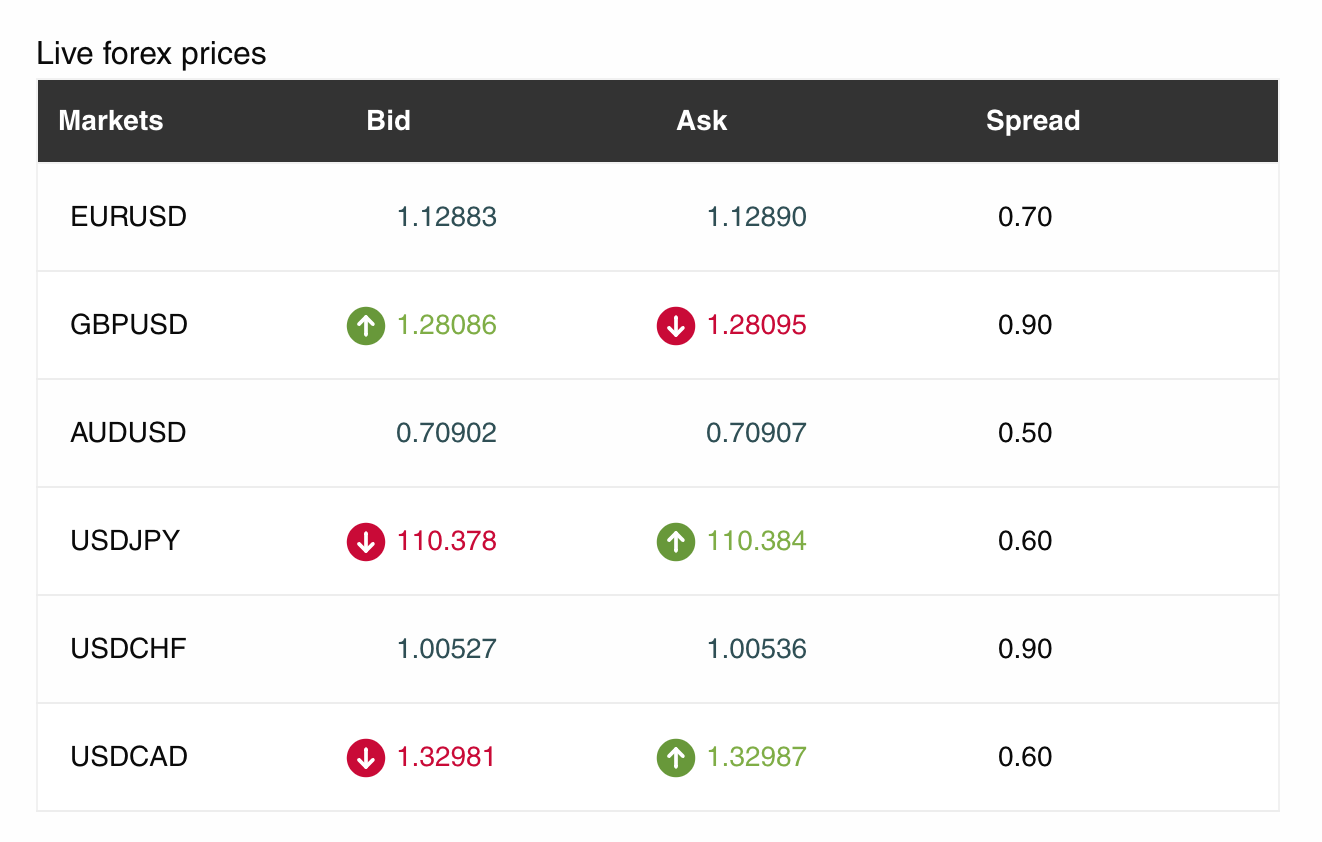

ThinkMarkets offers very competitive commissions and fees when compared to other major brokers like Pepperstone, IC Markets and AxiTrader.

As mentioned above, Standard Accounts are not charged any commission, and traders can expect competitive spreads, starting as low as 0 pips.

ThinkZero Account holders are required to pay a commission of $3.5 per side (3 Euros / 2.5 GBP) on FX and Metals. This is an extremely low commission that is accompanied by even more competitive spreads, which start as low as 0 pips for ThinkZero Account holders.

*your capital is at risk. 71.18% of Retail CFD Accounts Lose Money.

Trading Platforms

ThinkMarkets offers three incredibly powerful trading platforms, including its own platform, ThinkTrader, alongside the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

ThinkTrader

ThinkTrader, ThinkMarkets’ proprietary trading platform, offers a very user-friendly interface while still managing to pack a number of powerful tools and components.

Users can trade directly from charts and have access to over 80 indicators, 50 drawing tools, and 14 types of charts. Moreover, users are able to receive 200 cloud-based notifications on any device to help them manage their positions and keep up with market news. These cloud-based notifications can be personalized according to your preferences and to alert you when certain market conditions are met. For example: Traders can receive a notification when the price on EUR/USD crosses a certain threshold. Other notifications that can be personalized include: Price triggers, order execution, and technical indicator triggers, such as crossovers, thresholds, oscillators, and more.

When you open up the platform, you’ll see charting, open positions and instrument list panels. In the instrument list panel, you can access a number of useful tools, such as an economic calendar, news headlines and trade signals.

ThinkMarkets’ ThinkTrader also offers the TrendRisk Scanner tool, which allows traders to scan markets and spot high-probability trades.

Overall, ThinkMarkets’ own ThinkTrader platform is a powerful and intuitive platform that is sure to offer a pleasant experience to traders of any level.

ThinkTrader Web

ThinkMarkets offers a highly interactive web version of its proprietary platform; ThinkTrader. With more than 125 indicators, 50 drawing tools, 20 chart types and up to 10 watchlists, ThinkTrader Web gives traders access to high-performance tools without needing to download an app. Users also have the choice of the MT4 and MT5 web versions.

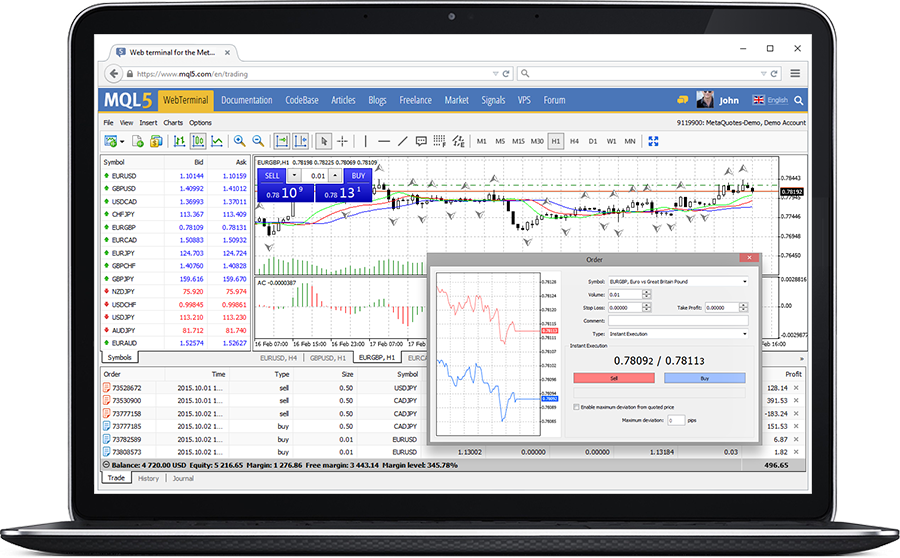

MetaTrader 4

As should be expected from any forex trading broker, ThinkMarkets also offers access to MetaTrader 4 — what many would consider to be the industry standard forex trading platform. MT4 offers an extremely advanced charting package with integrated access to Trading Central and over 100 indicators.

Trading Central is a leading trading tool widely used by individual traders, hedge funds, brokers and financial institutions for research on financial products. The product suite includes both human and automated technical, fundamental, and value-based analytics interpretation. Trading Central enables today’s traders to engage in the financial markets by assisting them in the generation of trading ideas, the validation of trading decisions, and the management of risk.

ThinkMarkets customers who use MT4 also have access to Virtual Private Servers (VPSs). This allows traders to access and manage their automated trading strategies easily and efficiently. Traders have 24-hour access and can use Expert Advisors to optimize their trading experience.

By offering ThinkTrader, and MetaTrader 4, and MetaTrader 5 ThinkMarkets is able to provide traders with an array of tools that they might need to be successful. All platforms are incredibly intuitive and offer a variety of tools and resources. Customers can’t go wrong when choosing between these platforms.

MetaTrader 5

ThinkMarkets clients also have access to the latest MetaTrader 5 platform which comes with exceptional benefits as well as a broad range of technical analysis tools.

This next generation trading platform offers several additions to the MetaTrader 4 platform. In particular, the MT5 offers 21 timeframes in comparison with MT4 that only offers 9, allowing traders to have an in-depth market analysis. In addition, MT5 offers two more pending orders ; including a buy stop-limit order and a sell-stop limit order for an even more tailored trading experience. The built-in economic calendar as well as the availability of partial order filling are also some of the features of the latest offering from MetaTrader.

The MT5 platform is compatible with most devices, including Windows, Mac OS, iPhone, iPad and Android. It is also compatible on a large variety of browsers including Google Chrome, Mozilla Firefox, Internet Explorer and more.

All in all, the MT5 platform has successfully managed to integrate the latest trading tools and features to satisfy the growing needs and strategies of different traders around the globe. With the inclusion of MT5, ThinkMarkets clients have an additional trading platform to choose from.

ThinkInvest

ThinkInvest is ThinkMarket’s Money Manager partnership program. It provides profitable traders with the opportunity to be compensated for their expertise.

According to ThinkMarkets, ThinkInvest allows experienced traders to join the ThinkInvest platform where other traders can view their performance and choose them to manage their money. ThinkInvest ranks Money Managers based on their performance and displays their results on a leaderboard.

Traders who join this program can implement their own conditions, such as how much they charge for their services and how much minimum capital they require.

ThinkInvest allows experienced traders to profit off of their advanced knowledge and allows novice traders to confidently hand over their portfolios to those who are more capable than them.

Mobile Trading

It is very important that brokers offer satisfactory mobile trading options. As traders go about their day, they are not always able to access a computer, and just a few seconds can make a huge difference in the world of trading. Fortunately, ThinkMarkets offers a few very reliable mobile trading options for its customers.

ThinkTrader is available on both iOS and Android. ThinkTrader is one of the best mobile trading platforms on the market as it is one of the few mobile platforms that matches the capabilities of its desktop and web-based counterparts. Mobile traders have access to 50+ drawing tools, more than 80 technical indicators, in-app deposits, news updates, and quad-screen views.

Additionally, you can connect your devices in order to receive cloud-based notifications to ensure that you never miss a trading opportunity. The intuitive interface combined with its powerful features makes the ThinkTrader mobile app one of the best mobile trading platforms available.

Fortunately for users who prefer the MetaTrader platforms, the MT4 and MT5 mobile apps are also incredibly powerful.

MetaTrader 4 Mobile – For illustrative purposes

MT4 mobile users can easily manage positions, review balances, receive live news updates, and more.

With a plethora of technical indicators, lightning-fast execution speeds, and access to other powerful resources, MetaTrader 4 is an ideal mobile trading platform for both novice and experienced traders.

Deposits & Withdrawals

For the benefit of its customers, ThinkMarkets accepts several methods of making deposits and withdrawals, including:

- Debit/Credit Cards

- Bank Transfers

- PayPal

- Skrill

- Neteller

*Deposit methods vary by country of residence / ThinkMarkets entity.

As no one enjoys waiting for their money, traders should be pleased to know that ThinkMarkets processes withdrawals very quickly, with usual processing times being within 24 hours. It may take between 1-7 business days for you to receive your funds depending on the withdrawal method.

Customer Service

ThinkMarkets offers incredible 24/7 customer support. ThinkMarkets customer service can be contacted through phone, e-mail and live-chat.

Moreover, ThinkMarkets offers multilingual support in order to satisfy the needs of its increasingly diverse clientele.

Overall, ThinkMarkets customers can expect to receive reliable, accurate and timely support whenever they need it.

Additional Resources

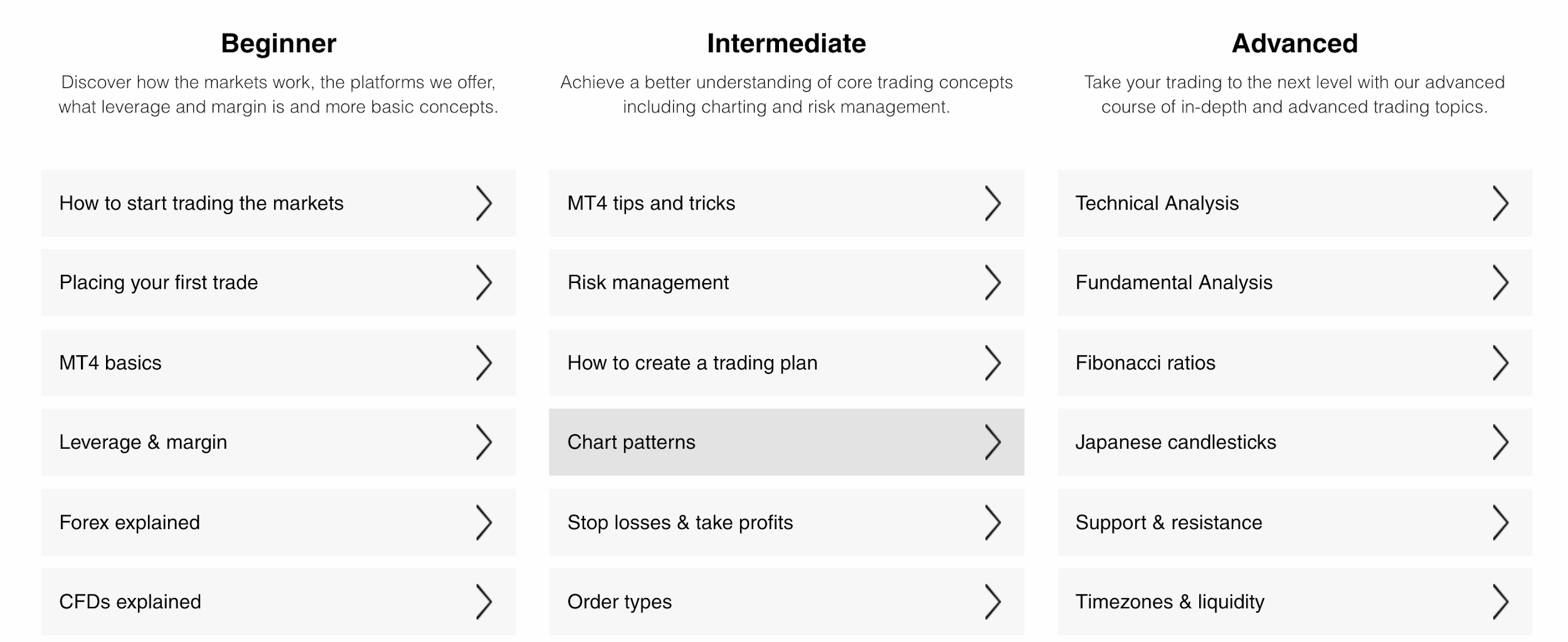

One of the greatest additional benefits offered by ThinkMarkets is its ‘Learn to Trade’ educational resource. This feature offers trading lessons for beginner, intermediate and advanced traders.

The beginner section includes lessons such as ‘How to Start Trading the Markets’ and ‘MT4 Basics.’ Intermediate traders are offered courses such as ‘Risk Management,’ ‘Chart Patterns,’ and ‘Order Types.’ Lastly, Advanced traders can access lessons such as ‘Technical Analysis,’ Fibonacci Ratios,’ and ‘Timezones & Liquidity.’

ThinkMarkets’ extensive educational resources provide traders of any level with the opportunity to develop more effective trading strategies.

Final Thoughts

ThinkMarkets is a great option for both novice and experienced traders in search of a forex broker.

ThinkMarkets offers incredibly competitive spreads and commission rates. In addition, the broker’s incredibly fast and reliable execution ensures that traders can count on the quoted spreads to be accurate.

ThinkTrader, MetaTrader 4, and MetaTrader 5 offer traders three of the most powerful trading platforms available on both desktops and mobile devices. With incredibly powerful charting capabilities, access to a plethora of technical indicators, and access to news updates and market analysis, both MT4, Mt5 and ThinkTrader are fantastic platforms for beginners and more knowledgeable traders.

Lastly, ThinkMarkets extensive educational resources offer traders of any experience level the ability to expand their knowledge and develop their trading strategies.

MT4 also grants users access to real-time news via FX Wire Pro. FX Wire Pro employs thousands of journalists who provide in-depth economic commentary to help you stay on top of important trends.

All things considered, ThinkMarkets is an ideal option for anyone looking for reliable and regulated major forex brokers.

*your capital is at risk. 71.18% of Retail CFD Accounts Lose Money.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.18% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.