MT4 vs. cTrader – Which Forex Trading Platform is Better?

MT4 vs. cTrader – Which Forex Trading Platform is Better?

From the time the MetaTrader 4 (or MT4) platform was initially launched in 2005 it has the dominated retail Forex industry as the preferred FX trading platform. Several estimates suggest that between 70-80% of all retail Forex traders use this trading platform. This is due in large part due to its ease of use, continual software improvements that have helped improve the overall functionality over the years and customization, which allows traders to easily create their own custom indicators and algorithms. Even though MT4 is over 12 years old, and Metaquotes has released its newest trading platform, MT5, many FX traders prefer sticking with what is familiar. Over the years, there have been many rivals to MT4, most notably the cTrader platform, which has proven to be a formidable opponent. The cTrader platform was launched in 2011 by Spotware and has gained a considerable market share. There are many reasons for this and in this article, we explore the similarities and key differentiators between these two leading Forex trading platforms. In this article we tackle the MT4 vs. cTrader Forex trading platforms.

MT4 vs. cTrader – in-depth comparison

Market Depth

A feature that increasingly sought after by retail Forex traders is Market Depth or Depth of Market. Market Depth provides traders with key information regarding the quantity of buy and sell quotes at different price levels. In on-exchange markets, Market Depth is available on any Level II screen, where all traders’ bids and offers are displayed for market participants to see. In an over-the-counter market like Forex, Market Depth is not something readily available as there is no centralized exchange where all orders are sent. For Forex traders, however, this information can be useful, especially for traders trading in large size.

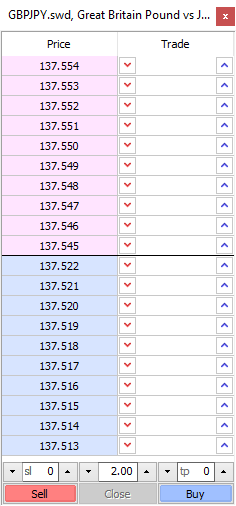

Market Depth on MT4

When the MT4 platform was initially released it did not contain a Market Depth feature. Traders trading on this platform only saw the best bid/offer price, but no information regarding the quantity available at that price was available. It was only after years of requests did Metaquotes finally upgrade their platform to include Market Depth. Even then, however, most brokers did not fully implement the tool into their platform because it requires third party plugins to allow data to be displayed. This essentially renders the Market Depth feature on the MT4 platform useless. An example of how this tool appears on the MT4 platform can see been below.

Market Depth on cTrader

cTrader was fortunate to enter the Forex platform provider space much later than MT4. As a result they understood the demand that existed for a Market Depth, and they developed a highly sophisticated Market Depth tool that is at the core of the trading platform. In fact, the cTrader platform shows a full depth of bids and offers and the available quantities at each price. Additionally, traders have the option of doing a VWAP (volume weighted average price) view, which will show the average price for a given trade size, which can be very useful if a trader trades in large size.

Overall, when it comes to Market Depth, cTrader is the better, more functional option. The drawback is that not nearly as many Forex brokers offer cTrader as a platform option. An example of how this tool appears on the cTrader platform can see been below.

MQL4 vs. cAlgo

One of the main reasons the MT4 platform has experienced such a long reign as the leading Forex platform is due to the ease with which traders can custom program their own indicators and algorithms via the MQL4 coding language and their built-in strategy tester. Any competitors to MT4 that wanted to attract algorithmic traders would need to have to offer an equally accessible and easy to use customer programming suite. Spotware did this when building the cTrader platform.

|

|

MT4 – Custom Indicators and Expert Advisors

MT4 coined the term Expert Advisor (EA), which simply means automated trading algorithms. There has been an entire sub industry that has sprouted up around EAs, with programmers building, licensing/selling them through various websites and Metaquotes own ecommerce market. MT4 scripts are written in the MQL4 language, which is unique to MT4 and borrows heavily from the C family of programming languages, which allows for advanced programs to be built.

The MQL4 language is also considered by many to be very user friendly, and there are even tools that allow traders to build EAs without knowing any computer programming languages. In addition, there are a host of different MQL4 web forums to answer questions and also firms who will build EAs for traders in exchange for a fee. Due to these items and the marketplaces where people buy and sell their indicators and EAs, MT4 has thrived.

cTader – Custom Indicators and Algorithms

Spotware anticipated the interest in developing custom indicators and algorithms when it developed the cTrader platform, as it incorporated its own ways for traders to develop and test custom indicators and algorithms. Like the Market Depth feature, Spotware made it a focal point of the cTrader platform. cTrader supports algorithmic and automated trading via cAlgo. cAlgo utilizes C# computer programming language as its language of choice, which is a popular object-oriented programming language with a large number of dedicated programmers around the world. While this programming language is extremely powerful and allows for high customization, it can be difficult for people who do not understand programming. Additionally, there are not many tools available to assist traders in developing their own automated strategies. This means that a lot of traders have to either purchase someone else’s automated strategy or hire someone to code it for them.

One website that has sprouted up is 2calgo.com. This website allows someone with an MT4 Expert Advisor to upload their script and it will automatically convert the program to work with cTrader. This tool has proven to be a very useful tool for cTrader to gain in popularity, though Forest Park FX has not tested how well it actually works.

Overall, we would give MT4 an edge over cTrader when it comes to automation given the ease of use in developing EAs, the number that are available for purchase, and the massive community formed around the MQL4 programming language make it the better solution for automated trading.

Charting

MT4 Charting

A key feature to the MT4 platform is its charting. The platform revolutionized the trading industry by giving traders the ability to trade directly from the charts, which was a feature not previously available. At the time Metaquotes’ release of MT4, the charting features were highly sophisticated with an extensive range of professional tools and indicators that came standard. Although, some of these features are starting to become outdated, two of which are the inability to change the server time on the charts and the timeframes with which you can view pricing data.

The MT4 platform only comes with 9 timeframe options: 1 minute, 5 minute, 15 minute, 30 minute, 60 minute, 4 hour, daily, and weekly. As trading has advanced, many traders have requested custom timeframes. Unfortunately, the MT4 platform is not able to support them. With MT5, however, Metaquotes has expanded the number of timeframes to 21.

Another feature that a lot of traders love about the MT4 platform is the ability to load an unlimited number of charts. And with the prevalence of EAs with MT4, it is not unheard of for traders to be running 30-40 charts at a time.

cTrader – Charting

Again, Spotware had the district advantage of coming into the game after Metaquotes. As with other features, they took note of the features traders liked and the ones they disliked.

Like MT4, cTrader allows you to have unlimited charts. But, cTrader took it one step further and allows you to export those charts out of the platform. One of the negatives about MT4 is that even though you can have unlimited charts, those charts have to remain in the MT4 terminal, thus eliminating the amount you can have visible at a time. Spotware saw this as shortcoming of the MT4 platform and capitalized by allowing traders to export or pop the charts out of the platform and put them anywhere they want on their computer monitors.

Another feature that cTrader offers is one click trading feature that allows traders to trade directly from the charts. MT4 gives traders basic buy and sell functionality in their one click trading tool, where you only have the options to select your trade size and then execute market orders. cTrader, however, expanded upon this feature by allowing traders to not only to execute market orders, but also set pending orders, look at the overall market sentiment, view the current spread, and several other additional features that MT4 does not offer. A comparison of the one click trading options offered by cTrader and MT4, respectively, can be seen below.

For these reasons set forth above, we give cTrader the edge over MT4 when it comes to charting features and functionality.

Brokerage Availability

The final topic we will discuss between the two platforms is availability across brokerage firms. This category hands down goes to MetaTrader 4. Almost every single Forex broker offers the MT4 platform, making it easy for traders to switch between brokers without the need to change platforms. While the cTrader platform has been popular among traders, it has not gained as much traction with brokers. While there are in excess of 1,000 MT4 brokers, there are only a dozen or so brokers that offer cTrader, of which only several are regulated and reputable. So, if you are keen on using the cTrader platform you are limited in the number of brokers that you can use.

Forest Park FX currently works with three of the leading Forex Brokers that offer cTrader: IC Markets, FxPro, and Pepperstone.

That wraps up our comparison between the MT4 vs. cTrader platforms. What we covered in this article only goes over several topics of what makes up a platform. It also is important to note a platform is only one factor in selecting a broker. There are a host of other variables that are important to consider, along with pricing model, execution model, regulation, and technology, among other factors. If you are unsure which broker or platform is right for you, make sure to complete our broker consultation form in order to speak with one of our industry professionals.

|

|